In this episode of Kangkang class, let's analyze and forecast the overseas module market demand in 2023 through China's export data.

In 2022, China exported USD 42.347 billion of global PV modules, a record high. This amount translates into an export equivalent of 156 GW (the price of single-watt modules used for conversion is based on the Infolink’s report ), up 47% year-on-year in 2021.

From January to February of 2023, China exported 6.96 billion US dollars of PV modules, equivalent to 30 GW of export volume, an 18% increase compared with the same period in 2022, of which the growth rate of Europe, Africa and North America exceeded 50%.

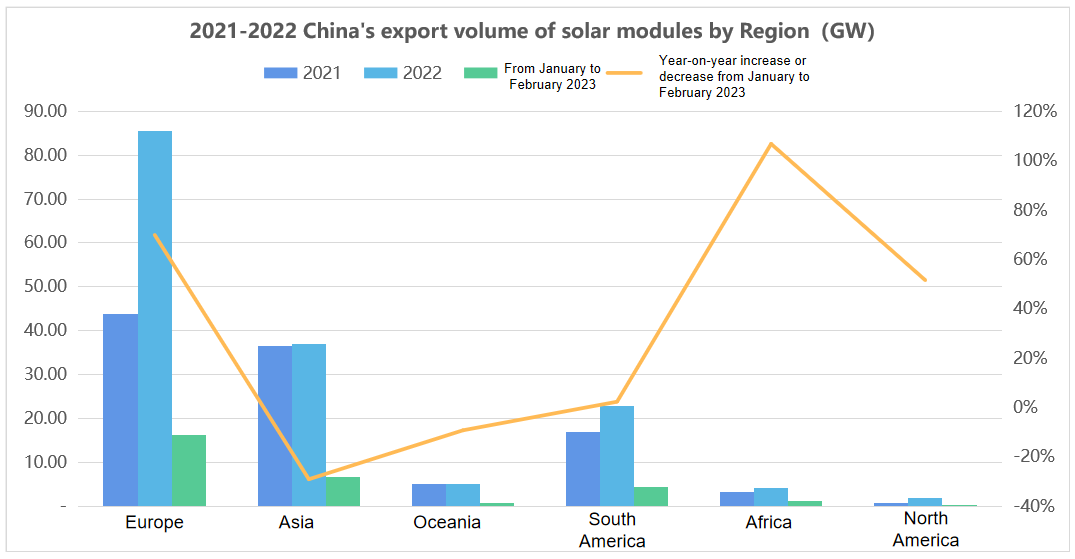

▲ 2021-2022 China's Export volume of solar modules

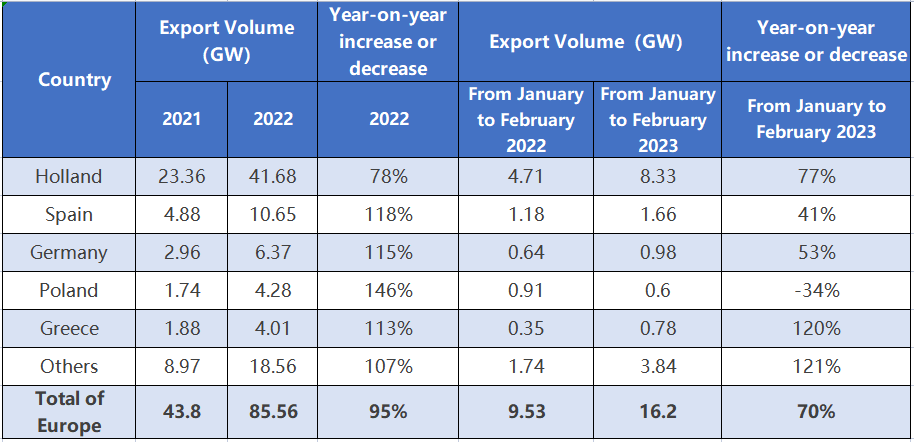

01 Europe

In 2022, Europe imported 86 GW of modules from China. According to the report of European Photovoltaic Association, the installed capacity of European Union in 2022 was 41.4 GW. Considering the capacity ratio, installed capacity in non-EU countries, a small amount of unrecorded installed capacity and other factors, the inventory of uninstalled modules left in Europe by the end of 2022 exceeded 30 GW.

From January to February 2023, China exported about 16.2 GW of modules to Europe, up 53% from the same period in 2022, indicating that the European market will continue to boom this year.

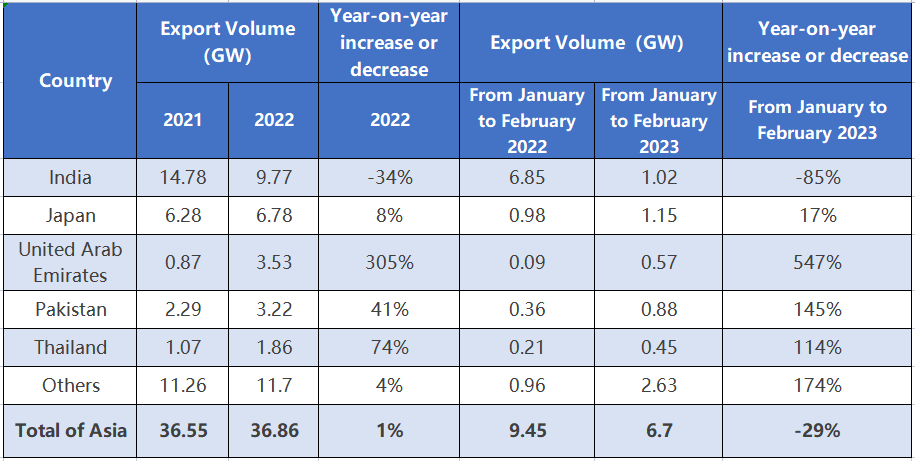

02 Asia

In 2022, the import volume of modules in India shrank sharply due to the initiation of the BCD tariff. South Korea also decreased by more than 35% and Japan increased slightly. However, the rapid growth of the markets in the Middle East and Southeast Asia such as the United Arab Emirates, Pakistan and Thailand has also been observed, and the volume of modules exported by China to the whole Asia-Pacific region in 2022 will be basically equal to that in 2021.

From January to February 2023, China exported about 6.7 GW of modules to other Asian markets, 29% less than the same period in 2022 due to the influence of the Indian market. However, a number of non-India markets have achieved growth. In addition to Japan, UAE, Pakistan and other markets stable play, Cambodia, Singapore and other markets have achieved from tens of MW to hundreds of MW growth.

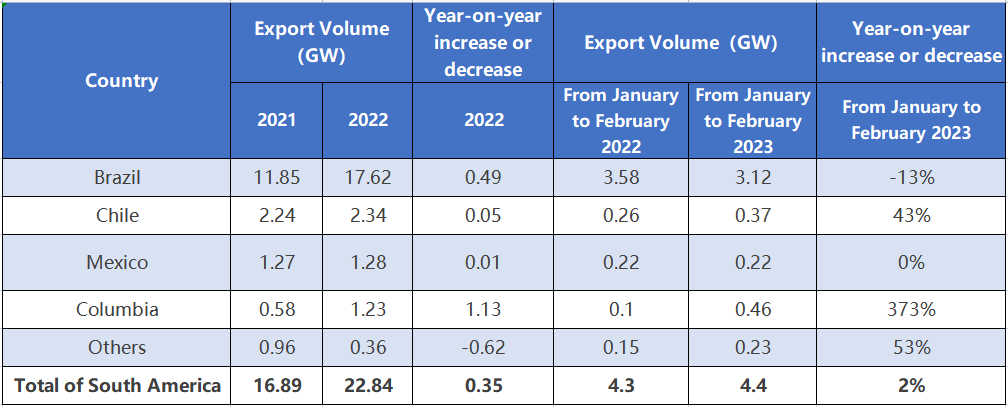

03 South America

In 2022, the volume of modules exported by China to the South American market amounted to 22.84 GW in equivalent, of which Brazil contributed 17.62 GW.

Brazil's charging policy for small photovoltaic systems in 2023 is postponed to July 2023, so the terminal installation market will remain hot in the first half of the year. However, due to the large amount of remaining uninstalled modules imported in 2022, the amount of modules imported from China to Brazil in January-February 2023 will decline by 13% year-on-year.

In addition to the Brazilian market, the import volume of modules from China to Chile and Colombia increased significantly from January to February this year.

04 Other markets

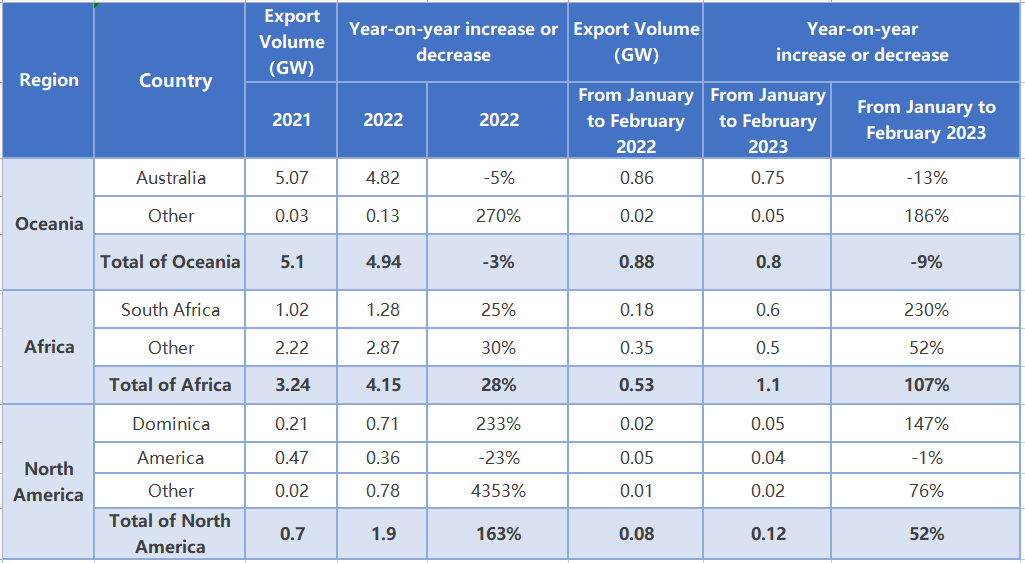

In 2022, in the markets of Oceania, Africa and North America, except for the Oceania market affected by Australia, the volume of modules imported from China decreased year-on-year, other markets all had varying degrees of growth. With the exception of Australia and South Africa, the import volume of other markets has not exceeded 1 GW, but most countries achieved year-on-year growth in 2021, showing a trend of more and more blooming.

From January to February 2023, the volume of modules exported to the African market by China still maintained a high growth rate, doubling from the same period in 2021. Although the volume of modules imported from China in the first two months of this year still continues the downward trend in 2022, there are still 4.6 GW of public projects under construction in Australia, as well as the power grid reconstruction plan and coal-free power generation plan released by the federal and state governments last year. This year, the Australian market is still worthy of expectation and is expected to start in the second quarter of this year.

05 What's the global strategic layout of AKCOME in 2023?

In 2023, Akcome will continue to focus on the arrangement of the global market. Based on the headquarters in Zhangjiagang, China, it will focus on the arrangement of Europe, Asia, America and other overseas regions, continuously radiate the surrounding emerging photovoltaic market, and provide more efficient, reliable and higher-value photovoltaic products and one-stop solutions for global customers.

受付時間:平日 8:00-17:00

HQ: 0571-89089399

Sales: +86-512 8255 7328

Mail: modulesales@akcome.com

本社: 浙江省杭州市余杭区余杭街文儀西路1818-2号1号館901号室